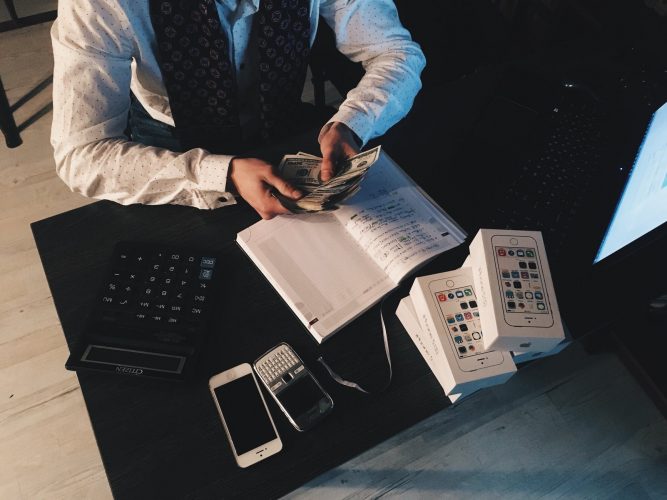

“When your outgo exceeds your income, your upkeep leads to your downfall.” Everybody has heard that one. But it’s usually a little more complicated than that when it comes to increasing your cash flow.

Increasing your cash flow is about knowing where the money is coming from and where it is going. And as that saying implies, when you have more money coming in than going out, it’s ideal. The trouble is that for many people, it’s not reality. It doesn’t matter whether you want to live better or pay off a debt. There are several ways to approach the situation. From more careful budgeting to finding qualified opportunity zone funds near me, a freer life will be the result. This article is designed to help you reach that goal.

Boost Your Income

The more money someone can make, the better. This gives someone more flexibility to eradicate debt and work towards a financial goal. It also provides someone more liquidity to weather the unexpected.

Invest

Bringing in more money can be easy, from taking on a second job to buying investments such as getting involved in opportunity zones. It is also possible to increase the deductions on your withholding, giving yourself an immediate raise.

Borrow

Unless you have a family member or a friend who is willing to loan you money interest-free, borrowing is usually not a good idea. It often just compounds the problems. On the other hand, this resource is a good one.

Ask for Discounts

Another option that almost no one ever thinks of is to ask for discounts. Wherever money is spent, ask for a discount. It might not happen, but it won’t hurt to ask. It all adds up.

Cut Your Expenses

Earning more money can certainly make it easier to increase cash flow, but it also increases the chances that you will spend more. Start with a budget, decide what expenses you have and what would be reasonable to cut. If there is no budget, it is still possible to analyze where the money will eliminate the expense. For example, nobody needs multiple streaming platforms, such as Netflix and Hulu. Consider having only one or the other. And if mealtime has been boiling down to a choice between Doordash and Grubhub, try opting for home-cooked. Once you have a handle on expenses, it’s easier to determine what you can cut overtime.

Pay Off Debts

Most Americans have debt, from credit card debts to mortgages, car loans, and student loans. Paying off these debts, even a small amount at a time can be a highly effective way to increase cash flow. One great way to pay off debt is with a debt avalanche and debt snowball.

Refinance the Debt

Besides paying off debt, there is another option: refinance it. A refinance is possible with nearly any type of loan, from student loans to home loans and even car loans.

Getting started on refinancing a loan is usually as easy as talking to a lender and filling out paperwork, and seeing a lower interest rate. If the lender is agreeable, not only will a borrower lower their interest rate, but their payment will go down as well.

Plan for Unexpected Expenses

It doesn’t matter how carefully you have planned and stuck to your plan, unexpected expenses will pop up when you least expect them. If there are infrequent expenses, why not set up a small fund to cover them? This will keep expenses paid for without disturbing your debt payment plan.

Avoid Temptation

It might seem obvious, but many people get tripped up when they start getting some leeway with their debts. After you have some money built up, don’t be tempted to celebrate by spending.

Reaching Your Goals

Anyone in debt or neutral cash flow would increase their cash flow to reach their financial goals. There’s no one best way to accomplish that, but this makes reaching goals that much easier since everyone can do it in a way that matches their best ability.

Whatever works for you is the best strategy for you. Try it. The only thing you have to lose is the debt.